Increasing Impact Of Stock Market Performance On Government Tax Revenues

DOI:

https://doi.org/10.18502/kss.v1i2.667Abstract

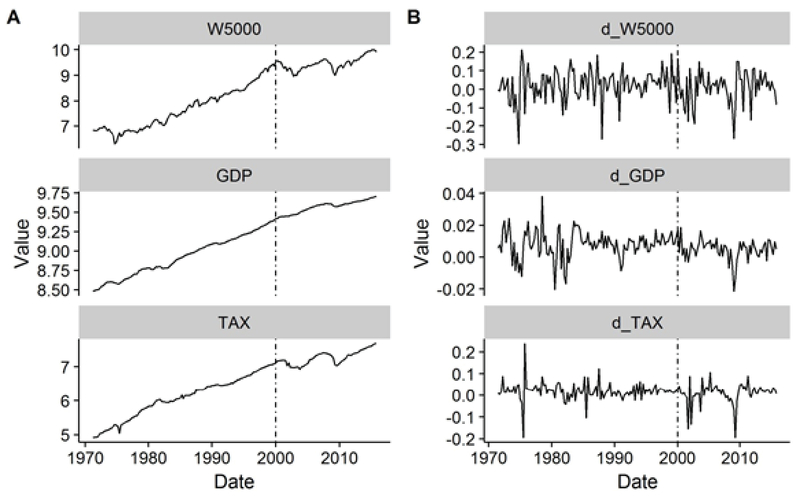

The aim of this paper is to investigate the relationship between fiscal policy, economic growth and stock market in the United States. This issue has gained importance in the last decade because the market has changed. A significance break has been detected which impacts the nature of the nexus between certain variables. The correlation between the tax revenues and the stock market has increased noticeably, encouraging the revision of the current approach to fiscal policy. This study examines relationship between three variables, namely real GDP, federal government current tax receipts and the stock market represented by the Wilshire 5000 Total Market Index. Quarterly data from 1971 to 2015 are used, divided into two subsets in the year 2000, because there is an obvious change in trend and volatility of the variables. The analysis uses ADF and KPSS unit root tests to find the order of the integration of the data. Subsequent analysis applies Johansen cointegration test, vector error correction model, Granger causality tests and variance decomposition analysis. The results demonstrate that the selected variables are cointegrated, and performance of the stock market significantly increases its influence on government tax revenues in the second period. The findings of this paper are significant for policy makers. Understanding how stock market development and economic growth influence tax revenues and vice versa is crucial for the efficient implementation of successful fiscal policy. Investors in the economy of the United States will be also able to benefit from these results which will help them to understand economic conditions and improve their investment decisions.

Keywords: Economic growth, stock market, tax revenue, VECM, variance decomposition

References

A. Alesina, S. Ardagna, R. Perotti, and F. Schiantarelli, Fiscal policy, profits, and investment, American Economic Review, 92, no. 3, 571–589, (2002).

S. Ardagna, Financial markets’ behavior around episodes of large changes in the fiscal stance, European Economic Review, 53, no. 1, 37–55, (2009).

K. P. Arin, A. Mamun, and N. Purushothman, The effects of tax policy on financial markets: G3 evidence, Review of Financial Economics, 18, no. 1, 33–46, (2009).

T. Beck, R. Levine, and N. Loayza, Finance and the sources of growth, Journal of Financial Economics, 58, no. 1-2, 261–300, (2000).

D. A. Dickey and W. A. Fuller, Distribution of the estimators for autoregressive time series with a unit root, Journal of the American Statistical Association, 74, no. 366, part 1, 427–431, (1979).

D. A. Dickey and W. A. Fuller, Likelihood ratio statistics for autoregressive time series with a unit root, Econometrica. Journal of the Econometric Society, 49, no. 4, 1057– 1072, (1981).

J. E. Golob, How Would Tax Reform Affect Financial Markets?. Federal Reserve Bank Of Kansas City, Economic Review, 80, no. 4, p. pp, (1995).

R. G. Holcombe and D. J. Lacombe, The effect of state income taxation on per capita income growth, Public Finance Review, 32, no. 3, 292–312, (2004).

S. Johansen and K. Juselius, Maximum Likelihood Estimation And Inference On Cointegration — With Applications To The Demand For Money, Oxford Bulletin of Economics and Statistics, 52, no. 2, 169–210, (1990).

R. B. Koester and R. C. Kormendi, Taxation, Aggregate Activity And Economic Growth: Cross-Country Evidence On Some Supply-Side Hypotheses, Economic Inquiry, 27, no. 3, 367–386, (1989).

D. Kwiatkowski, P. C. B. Phillips, P. Schmidt, and Y. Shin, Testing the null hypothesis of stationarity against the alternative of a unit root. How sure are we that economic time series have a unit root? Journal of Econometrics, 54, no. 1-3, 159–178, (1992).

Y. Lee and R. H. Gordon, Tax structure and economic growth, Journal of Public Economics, 89, no. 5-6, 1027–1043, (2005).

R. LEVINE, Stock Markets, Growth, and Tax Policy, The Journal of Finance, 46, no. 4, 1445–1465, (1991).

R. Levine, N. Loayza, and T. Beck, Financial intermediation and growth: Causality and causes, Journal of Monetary Economics, 46, no. 1, 31–77, (2000).

K. Marsden, Links between taxes and economic growth: some empirical evidence., World Bank Staff Working Paper, 605, (1983).

R. Ram, Financial development and economic growth: Additional evidence, Journal of Development Studies, 35, no. 4, 164–174, (1999).

D. Romero-Ávila and R. Strauch, Public finances and long-term growth in Europe: Evidence from a panel data analysis, European Journal of Political Economy, 24, no. 1, 172–191, (2008).

H. Y. Toda and T. Yamamoto, Statistical inference in vector autoregressions with possibly integrated processes, Journal of Econometrics, 66, no. 1-2, 225–250, (1995).