Awareness Of Smes On The Eu Funds Financing Possibilities: The Case Of Split-Dalmatia County

DOI:

https://doi.org/10.18502/kss.v1i2.666Abstract

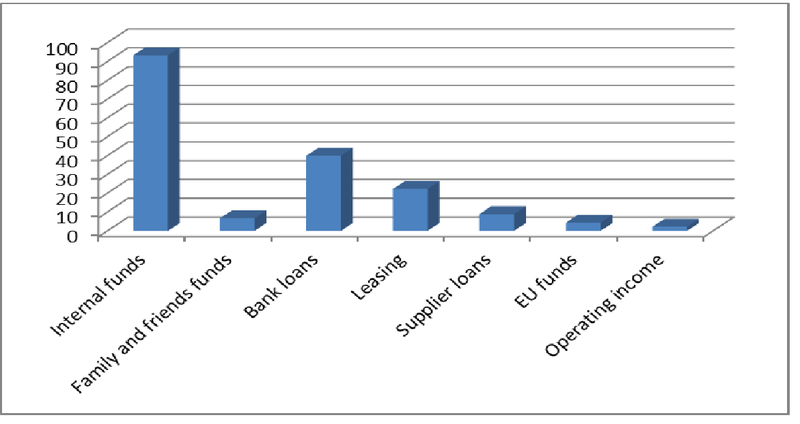

Micro, small and medium-sized enterprises (SMEs) are considered to be the engine of the European economy. In EU SMEs make up more than 99% of all companies and provide around 75 million jobs. They are a key source of job creation and stimulation of entrepreneurial spirit and innovation and are therefore essential for fostering competitiveness and maintaining employment in the EU. Yet SMEs often have problems in raising funds to finance fixed investments and inventory and working capital. SMEs mostly use internal sources while the most important external sources of SMEs are bank loans, which are not easily accessible. Hence, one of the priorities of the European Commission is stimulating SMEs through EU funds and programs in order to enable SMEs development and finally to contribute to economic growth. SMEs sector also dominates the economic structure of Croatian economy and they have similar financing problems. However, Croatia in period 2014 – 2020 have at disposal a total amount of 10.676 billion of euros from European structural and investment funds, of which 8.397 billion are aimed for cohesion policy objectives and 470 million euros are aimed for the development and competitiveness of SMEs. Besides, EU programs COSME and HORIZON 2020 are intended to provide direct support to SMEs and to create a favorable environment for their development. However, even though the number of successful project applications for small and medium-sized enterprises in the total share of Croatian project applications is relatively high, fund absorption has not reached satisfactory levels. Using the sample of Split-Dalmatia County’s SMEs, this study finds out reasons for low absorption capacity from SMEs point of view: SMEs are interested in funds from European Union, but are not sufficiently familiar with their availability i.e. funds at their disposal, especially programs COSME and HORIZON 2020; SMEs state that they know how to apply for EU funds but considered the procedure as complicated and demanding regarding documentation, and that the needed knowledge and know-how for proposal is beyond their scope; SMEs are not satisfied with the cooperation with state institutions, especially Ministry of Regional Development and EU funds and Croatian Chamber of Economy. We point out four main conclusions: (1) SMEs are not enough aware of EU financing possibilities; (2) additional promotion of EU programs directly to SMEs is required; (3) additional education of SMEs regarding project proposal and documentation is needed and (4) more proactive policy of state institutions and cooperation with local authorities is expected. Finally, greater awareness and professional help might be a key in strengthening the SMEs, whose entrepreneurial spirit and innovation process is a prerequisite for economic growth and development.

Keywords: SMEs, awareness, EU funds and programs, absorption capacity, Split- Dalmatia County

References

T. Beck, A. Demirgüç-Kunt, and V. Maksimovich, Financing Patterns Around the World: The Role of Institutions. Policy Research Working Paper 2905, World Bank, DC, Washington, 2002.

I. Bujan and M. Vugrinec, Specificnosti financiranja SME sektora u Hrvatskoj u odnosu na zemlje Europske Unije, Zbornik Veleucilita u Rijeci, 2, no. 1, 127–138, (2014).

CEPOR. , Centre for Small and Medium Enterprise and Entrepreneurship, in CEPOR - Centre for Small and Medium Enterprise and Entrepreneurship, 1848–3526, Report on small and medium enterprises in, Croatia, 2015.

M. Curak, D. Mulac, M. Ćurak, and D. Mulač, Odrednice depozitnog potencijala banaka u Republici Hrvatskoj u Viducic.Lj, in in Viducic Small and Medium Enterprises; Financial Policy and Economic and Financial Framework support, Faculty of Economics, Lj. Vidučić, Ed., Split, 2012.

V. Ðulabic and V. Đulabić, Apsorpcijski kapacitet i koritenje sredstava fondova Europske Enije: izazovi i prilike za Hrvatsku. Edited by Musa, M., 2. Forum za javnu upravu, Friedrich Ebert Stiftung, Institut za javnu upravu, Apsorpcijski kapacitet i korištenje sredstava fondova Europske Enije, izazovi i prilike za Hrvatsku. Edited by Musa, 2012.

Bank. European Central, (2015)., Survey on the access to finance of enterprises in the euro area. European Central Bank, .

EUROPE. , A strategy for smart, sustainable and inclusive growth, European Union, European Commission, sustainable and inclusive growth, 2010.

Improving access to finance for SMEs: key to economic recovery, European Union, European Commission, 2013.

J. Le Cacheux and E. Laurent, Report on the state of the European union: Is Europe sustainable? Report on the State of the European Union: Is Europe Sustainable? 1–167, (2014).

European. Commission, Small and medium-sized enterprises’ access to finance, European semester thematic fiche, Small and medium-sized enterprises’ access to finance, European semester thematic fiche, (2015).

The new SME definition: User guide and model declaration. Enterprise and industry publications, European Commission, 2015.

European. Parliament, REGULATION (EU) No 1287/2013, establishing a Programme for the Competitiveness of Enterprises and small and medium-sized enterprises (COSME, REGULATION (EU) No 1287/2013, establishing a Programme for the Competitiveness of Enterprises and small and medium-sized enterprises (COSME, (2013).

European. Parliament, SME support in EU regions. EPRS|European Parliamentary Research Service, SME support in EU regions. EPRS|European Parliamentary Research Service, (2015).

Europski strukturni i investicijski fondovi, available at: http://www.strukturnifondovi.hr/eu-fondovi, [30.03.2016.].

S. Fraser, Finance for Small and Medium-Sized Enterprises: A Report on the, UK Survey of SME Finances. Centre for Small and Medium-Sized Enterprises Warwick Business School, University of Warwick, UK, A Report on the 2004 UK Survey of SME Finances. Centre for Small and Medium-Sized Enterprises Warwick Business School, 2004.

ICAEW - Institute of Chartered Accountants in England and Wales, UK, 2011.

Kagor d.o.o., 2015. Poticaji, potpore, EU fondovi-vodič za poduzetnike. [Internet], available at: http://www.kagor.hr/hr/usluge/eu-fondovi-i-bespovratna-sredstva/ [10.4.2016.].

O. Kaya, SME financing in the euro area, New Solutions to an old problem, Germany, Deutch Bank, 2014.

I. McMaster and J. Bachtler, Implementing Structural Funds in the New Member States:

Ten Policy Challenges, European Policies Research Centre University of Strathclyde, Ten Policy Challenges. European Policies Research Centre University of Strathclyde, 2005.

N. Michel, Finanzierungsmöglichkeiten für KMU unter Berücksichtigung steuerlicher Aspekte, Diplomica Verlag GmbH, Finanzierungsmöglichkeiten für KMU unter Berücksichtigung steuerlicher Aspekte, Diplomica Verlag GmbH, (2012).

Development Strategy of Entrepreneurship in Croatia, 2013., -2020. Ministry of Entrepreneurship, Ministry of Entrepreneurship, Zagreb, 2013.

D. Novotny, Koristiti EU fondove samo za infrastrukturne projekte je pogreka, Croatian Chamber of Economy, (2013).

I. Oncioiu, Small and Medium Enterprises Access to Financing A European Concern: Evidence from Romanian SME, International Business Research, 5, 47–58, (2012).

J. Puljiz, Analiza kapaciteta za koritenje EU fondova na upanijskoj razini. Institut za medunarodne odnose, IMO, Institut za medunarodne odnose, 2011.

M. Schiffer and B. Weder, Firm Size and the Business Environment: Worldwide Survey Results. Discussion Paper 43, International Finance Corporation

County. Split-Dalmatia, Razvojna strategija Spltisko-Dalmatinske upanije 2011-2013. Split-Dalmatia County, Croatia, Split, 2011.

Lj. Viducic and Lj. Vidučić, Financijska ogranicenja osnivanju i poslovanju malih i srednjih poduzeca, in in Viducic Small and Medium Enterprises; Financial Policy and Economic and Financial Framework support, Faculty of Economics, Lj. Vidučić, Ed., Split, 2012.

B. Wassermann, Neue Finanzierungswege für kleine und mittlere Unternehmen, Akademie Verlag, Neue Finanzierungswege für kleine und mittlere Unternehmen, Akademie Verlag, (2010).