Does a Venture Capital Market Exist in the Countries of Former Yugoslavia?

DOI:

https://doi.org/10.18502/kss.v1i2.657Abstract

Venture capital investments spread all over the world during the last few decades. Until then, they were considered only as an American phenomenon. Countries worldwide are interested in attracting venture capital investments because of their undisputable effects on the economy. The effects of the investments are visible through the impact on innovation, creation of new companies, jobs, economic growth, corporate governance and etc.

Venture capital is a subset of Private equity focused on start-up companies and companies having difficulties in attracting necessary capital. It represents an equity investment made for the launch, early development, or expansion of a business.

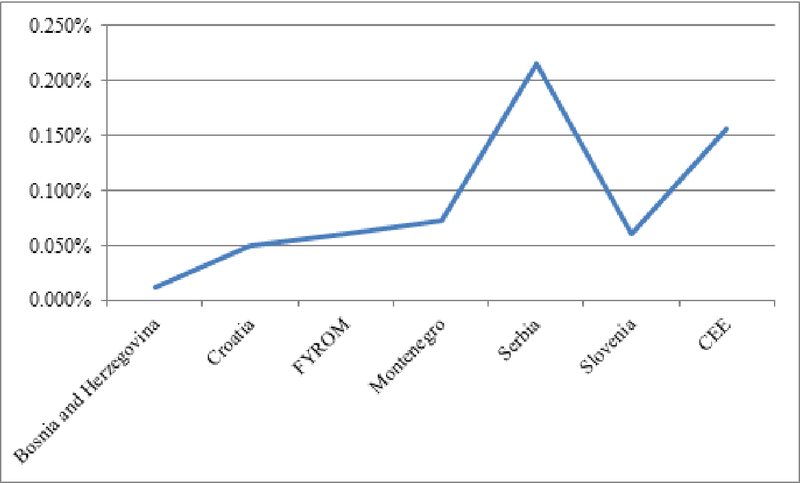

The countries of former Yugoslavia (Croatia, Bosnia and Herzegovina, Former Yugoslav Republic of Macedonia - FYROM, Montenegro, Slovenia and Serbia) are part of the Central and Eastern Europe countries and represent relatively a new market for venture capitalists. They moved from the planned economies to a free market system in the 90s of 20 century. As well as other countries in the World, these countries are also interested in attracting venture capital because of the proven impact on economic growth. Despite the presence of Venture capital and Private equity funds in this region for more than twenty years, the venture capital and private equity market in the countries of former Yugoslavia is underdeveloped compared to other countries of CEE. Indeed, the venture capital investments are so small for some countries of former Yugoslavia that the data about venture capital investment are published jointly.

The objective of this paper is to examine and analyze the development of Venture Capital market in countries o former Yugoslavia. The research is both qualitative and quantitative, and involves an identification, analysis and comparison of PE/VC investments data for selected countries. The time frame for this research is between 2007 and 2014. The total volume of venture capital investments per year, the number of companies invested and the ratio of PE investments to the gross domestic product (GDP) will be used to demonstrate the existence of the venture capital market in countries of former Yugoslavia. The data necessary for the current research were taken from the yearbook of EVCA/PEREP Analytics for 2014 for Baltics and Ex-Y. „PEREP Analytics” is a centralized, non-commercial pan-European private equity database. The „PEREP Analytics” statistics platform monitors the development of private equity and venture capital in 25 European countries.

Keywords: Venture capital investments, Former Yugoslavia, CEE, Venture capital market, economic growth

References

O. Badenko, N. Barsinska, and D. Schäfer, Are Private Equity Investors Good or Evil. Deutsches Institut für Wirtschaftsforschung (DIW), Germany, Berlin, 2009.

K. Bernoth, R. Colavecchio, and M. Sass, Drivers of Private Equity Investment in CEE and Western Europe Countries. Financial Systems, Efficiency and Stimulation of Sustainable Growth, Working Paper D.3.5, p. 25, (2010).

S. Caselli, Private Equity and Venture Capital in Europe, Private Equity and Venture Capital in Europe, (2010).

V. Cvijanovic, M. Marovic, B. Sruk, V. Cvijanović, and M. Marović, Financiranje malih i srednjih poduzeca, GIPA d.o.o, Financiranje malih i srednjih poduzeca, GIPA d.o.o, (2008).

European Private Equity and Venture Capital Association, (EVCA)., , European Private Equity Activity , Statistics on Fundraising, Investments Divestments, Belgium, Brussels, 2014.

European Private Equity and Venture Capital Association, (EVCA).Central and Eastern Europe Statistics, Belgium, Brussels, 2014.

S. Caselli, Private Equity and Venture Capital in Europe, Private Equity and Venture Capital in Europe, (2010).

European Private Equity and Venture Capital Association (EVCA, 2014., EVCA/PEREP Analytics for, 2014.

Frontier. economics, Exploring the impact of private equity on economic growth, in in Europe. Report for EVCA, p. 57, London, 2013.

M. Glas, M. Drnovek, V. Penicny, M. Drnovšek, and V. Pšeničny, Is Private equity capital really the solution, in Research in Entrepreneurship and Government Policy Making the Connection, p. 19, Belgium, Leuven, 2002.

J. Hecková and Z. Hrabovská, The Venture Capital market in the Slovak Republic. BIATEC, Volume XIV, 11/2006, 29–32, (2006).

K. Heilingbrunner and Sz. Katai, Comprehensive analysis of programmes and initiatives in Slovenia that assist the collaboration between science and SME, Report for the European Commission, in MaPEeR SME: Making Progress and Economic enhancement a Reality for SME, p. 37, MaPEeR SME, Making Progress and Economic enhancement a Reality for SME, 2010.

D. Kava and D. Kavaš, Expert evaluation network delivering policy analysis of the performance of Cohesion policy 2007-2013, Year 2 2012, Task 1: Financial engineering Slovenia, Institute for Economic research, p. 17, (2012).

E. Kozarevic, M. Kokorovic Jukan, E. Kozarevic, and M. Kokorović Jukan, SME bankarstvo (BiH i Inostrana iskustva, Tranzicija/Transition Vitez-Tuzla-Zagreb- Beograd- Bukarest, XVII, no. 34, 79–92, (2014).

D. Lazarevski, J. Mrsik, and E. Smokvarski, Evolution of the venture capital financing for growing small and medium enterorises, in in Central and Eastern Europe countries: the case of Macedonica. Munich Personal rePEc Archive (MPRA, paper No. 41997, p. 10, Evolution of the venture capital financing for growing small and medium enterorises in Central and Eastern Europe countries, the case of Macedonica. Munich Personal rePEc Archive, (2012).

D. Lazarevski, J. Mrsik, and E. Smokvarski, Private Equity Investing in Small and Medium Entreprises in Central and Eastern Europe with Special Review of Macedonia, Annals of, Eftimie Murgu , Resita, Fascicle II Economic Studies, 1, 172– 182, (2013).

N. Makojevic and N. Makojević, Venture capital funds alternative sources for economic development financing, Beograd, 13–20, (2011).

N. Milenkovic, Rizicni i privatni kapital u zemljama Centralne i Istocne Evrope. Doktorska disertacija, Ekonomski fakultet u Subotici, p. 266, (2015).

Review of the financial system, Slovenia, 2011.

Ð. Ognjenovic and Đ. Ognjenović, Hrvatska industrija rizicnog kapitala-realna i neiskoritena opcija financiranja tvrtki u razvoju, Banka br 8. Retriewed 26.01.2009. from, (2007).

http://www.ognjenoviclovergrove.com/publikacija/Private_equity_u_ Hrvatskoj.pdf.

V. Ramadani, Venture capital financing in the Republic of Macedonia: What is done and what should be done? ACRN Journal of Finance and Risk Perspectives, 3, 27–46, (2014).

A. Soloma, The Importance of the Depth of the Capital Market on International Venture Capital and Private Equity allocation decisions: The Case of Poland, 2013.18, 237–245

P. Strömberg, The Economic and Social Impact of Private Equity in Europe: Summary, of Research Findings, Stockholm School of Economics Director, Institute for Financial Research (SIFR, Summary of Research Findings, 2009.

M. Šimic, Atraktivnost Hrvatske u privlacenju ulagaca rizicnog kapitala. Ekonomska misao i praksa, Dubrovnik, god. XXIV, br. 1, 267–294, (2015).

P. Veselinovic, N. Makojevic, P. Veselinović, and N. Makojević, Venture Capital and Private Equity investing in Western Balkan Region, Beograd, 71–85, (2011).